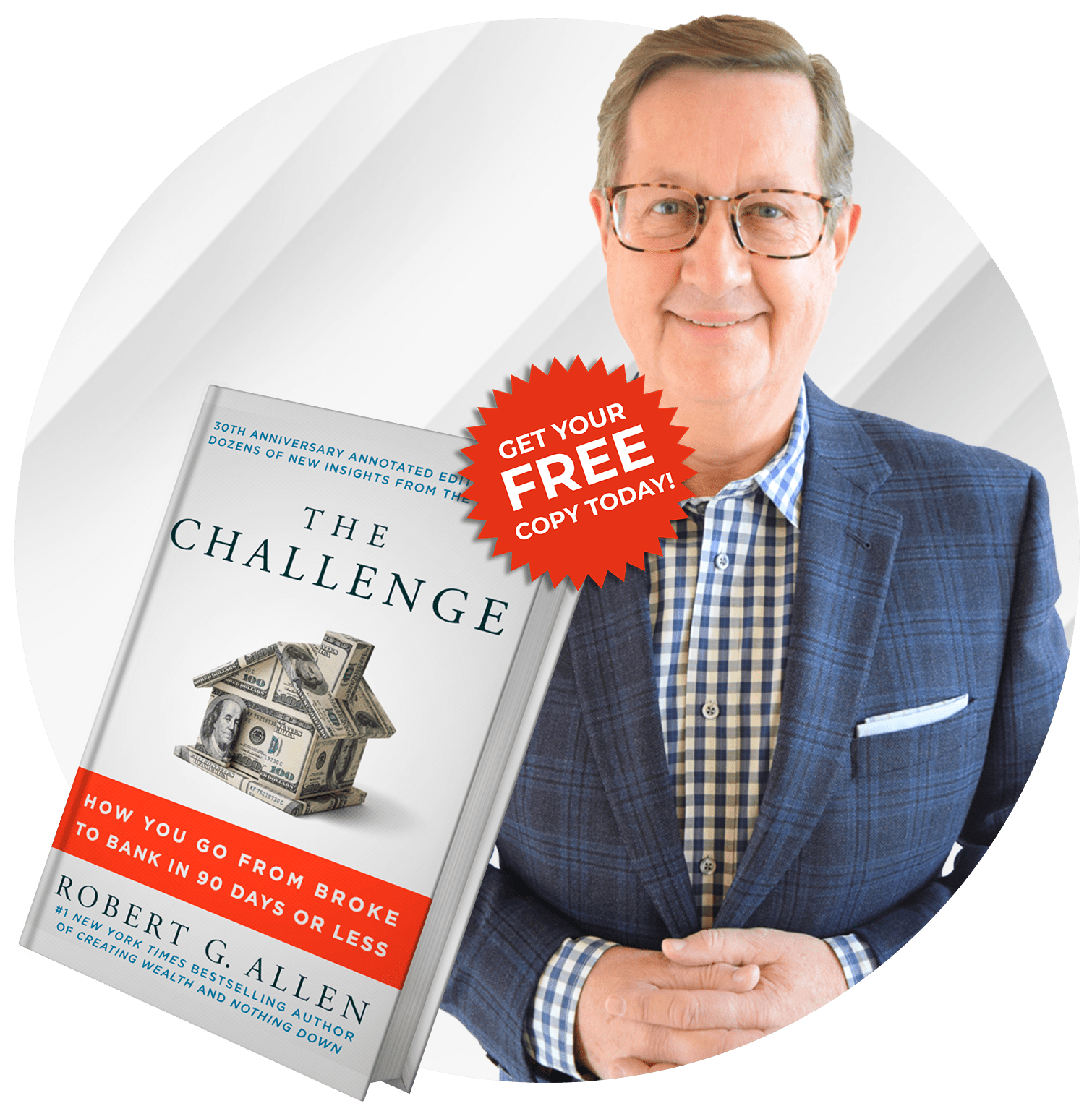

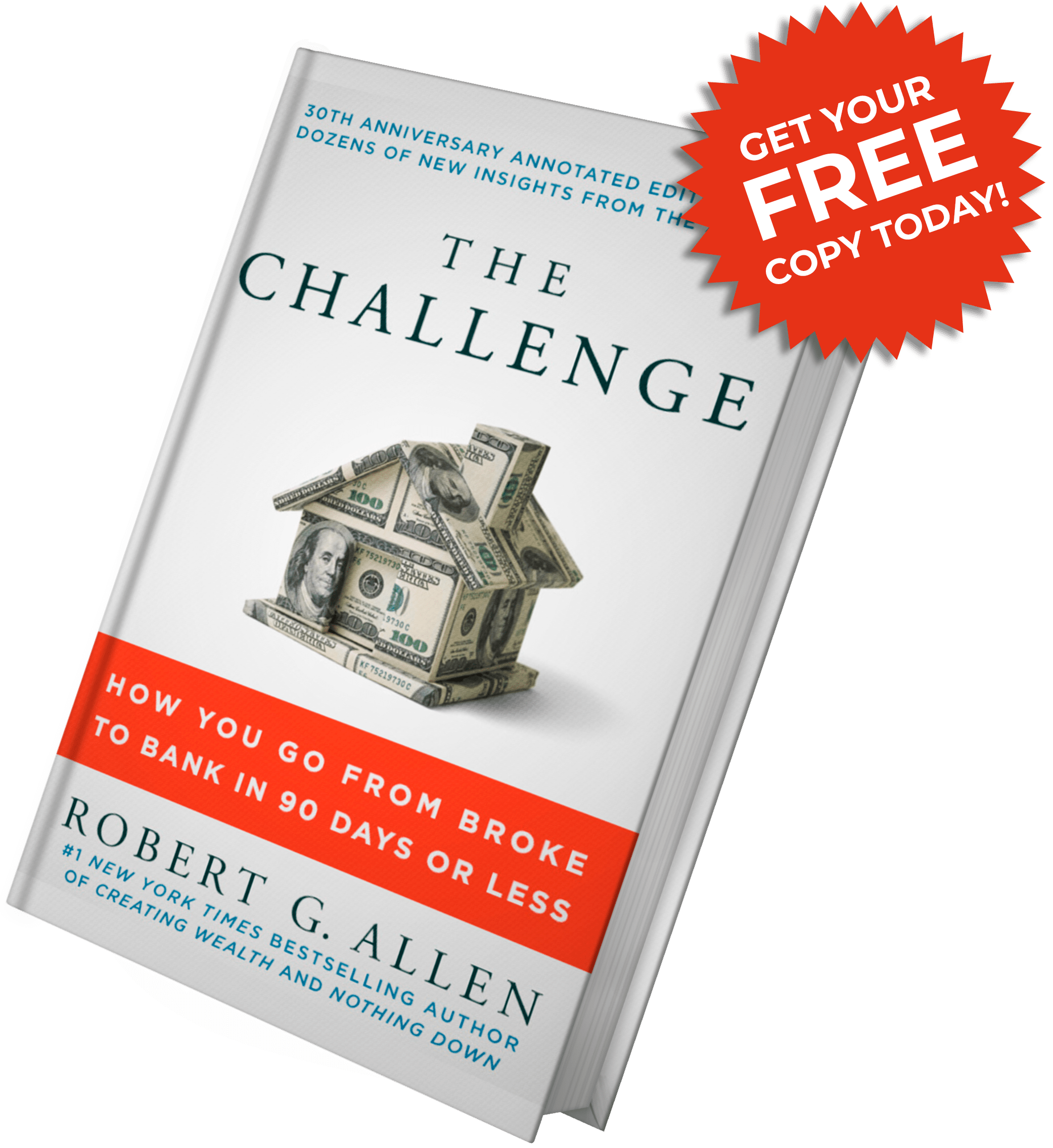

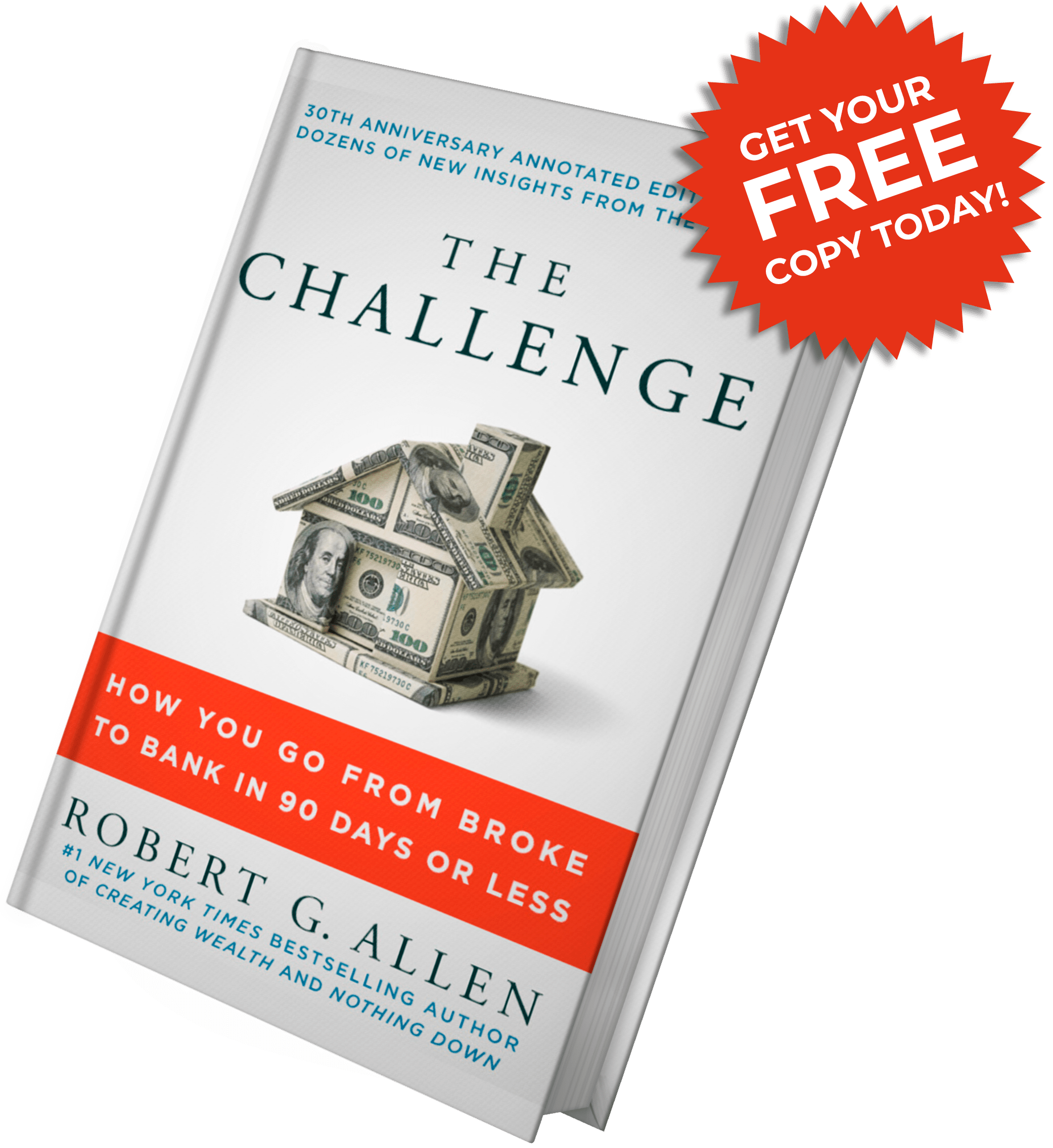

Limited Time Offer: Get a FREE Copy Of "The Challenge: How You Go From Broke To Bank In 90 Days Or Less"

Limited Time Offer: Get a FREE Copy Of "The Challenge: How You Go From Broke To Bank In 90 Days Or Less" - Click Here

⬇︎ CLAIM YOUR FREE BOOK ⬇︎

THE CHALLENGE

HOW YOU GO FROM BROKE TO BANK IN 90 DAYS OR LESS

BY #1 NEW YORK TIMES BEST-SELLING AUTHOR ROBERT ALLEN

⬇︎ CLAIM YOUR FREE BOOK ⬇︎

THE CHALLENGE

HOW YOU GO FROM BROKE

TO BANK IN 90 DAYS OR LESS

BY #1 NEW YORK TIMES BEST-SELLING AUTHOR ROBERT ALLEN

ROBERT HAS BEEN FEATURED ON:

CUSTOM JAVASCRIPT / HTML

GROW YOUR WEALTH THROUGH REAL ESTATE

WITH ROBERT ALLEN

FREE BOOK

THE CHALLENGE

HOW YOU GO FROM BROKE TO BANK IN 90 DAYS OR LESS

Discover the journey from broke to bank as you read the story of five individuals that went from unemployment to $5000 in the bank in 90 days.

ROBERT HAS BEEN FEATURED ON:

CUSTOM JAVASCRIPT / HTML

FREE BOOK

HOW YOU GO FROM BROKE TO BANK IN 90 DAYS OR LESS

Discover the journey from broke to bank as you read the story of five individuals that went from unemployment to $5000 in the bank in 90 days.

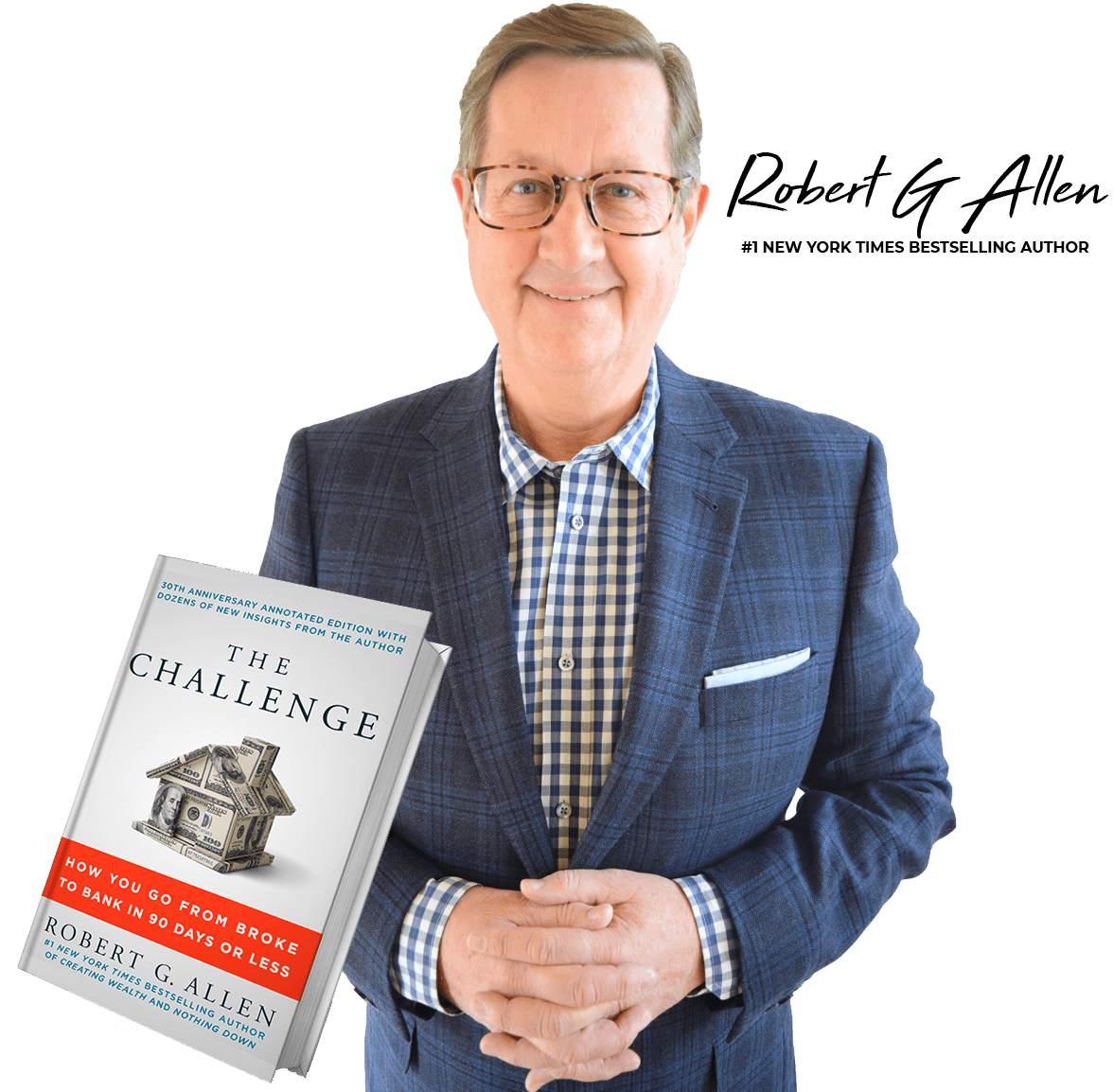

Who is robert G. allen?

#1 New York Times Bestselling Author Robert G. Allen

GET STARTED TODAY!

FREE OFFER ENDS SOON:

CUSTOM JAVASCRIPT / HTML

*This "Free Book + Bonus" offer expires when the countdown timer reaches zero. Get your free copy of "The Challenge: How You Go From Broke To Bake In 90 Days Or Less" today!

Who is

robert G. allen?

#1 New York Times Bestselling Author Robert G. Allen

GET STARTED TODAY!

FREE OFFER ENDS SOON:

CUSTOM JAVASCRIPT / HTML

*This "Free Book + Bonus" offer expires when the countdown timer reaches zero. Get your free copy of "The Challenge: How You Go From Broke To Bake In 90 Days Or Less" today!

INCREDIBLE BOOKS

New York Times Best Selling Author Robert G. Allen